Revision scheme of tax paid alleviates the financial burden of companies

The revision scheme ensures stable business operations via the early determination of the amount of customs duties

Where a taxpayer makes an amended declaration for deficient customs duty after a post-audit, he/she would have to pay additional duties and may be subject to penalties. This is why the self-revision system exists to support stable business activities and ease the business burden by enabling early determination of the amounts of revised duties.

Revision, Amendment, and Claim for rectification may be used to declare changes in duty amounts. Each scheme is applied based on the time period of filing application.

- In case of deficiency in customs duty within 6 months from the date of declaration and payment, →"apply for revision scheme of tax paid."

- In case of deficiency in customs duty after the revision deadline, → "make an amended declaration."

- In case of reporting the over-payment of the customs duty within 5 years from the date of declaration and tax payment, → "request rectification."

Self-Correction - Application for revision Amended Declaration Request for rectification Application Period Within 6 months from the date of payment From after the correction period Customs duty imposition exclusion period Within 5 years from the date of declaration and payment Increase or Decrease Increase in the customs duty Increase in the customs duty Decrease in the customs duty Interests ○ × × Additional Duties × ○ × Due Date The day after the date of the application for self revision The day after the date of the amended declaration 15 days from the date of receipt of notification on tax payment Customs duty imposition exclusion period: 5 years or 10 years (customs duty evasion, illegal refund, etc.)

- The time period for calculating interests of revised tax:

The period for calculating self-correction interests: Used to be From the day after the initial due date of duty payment until the date of payment for the revised customs Duty

Improved system From the day after the initial due date of duty payment until the date of the application for tax-revision

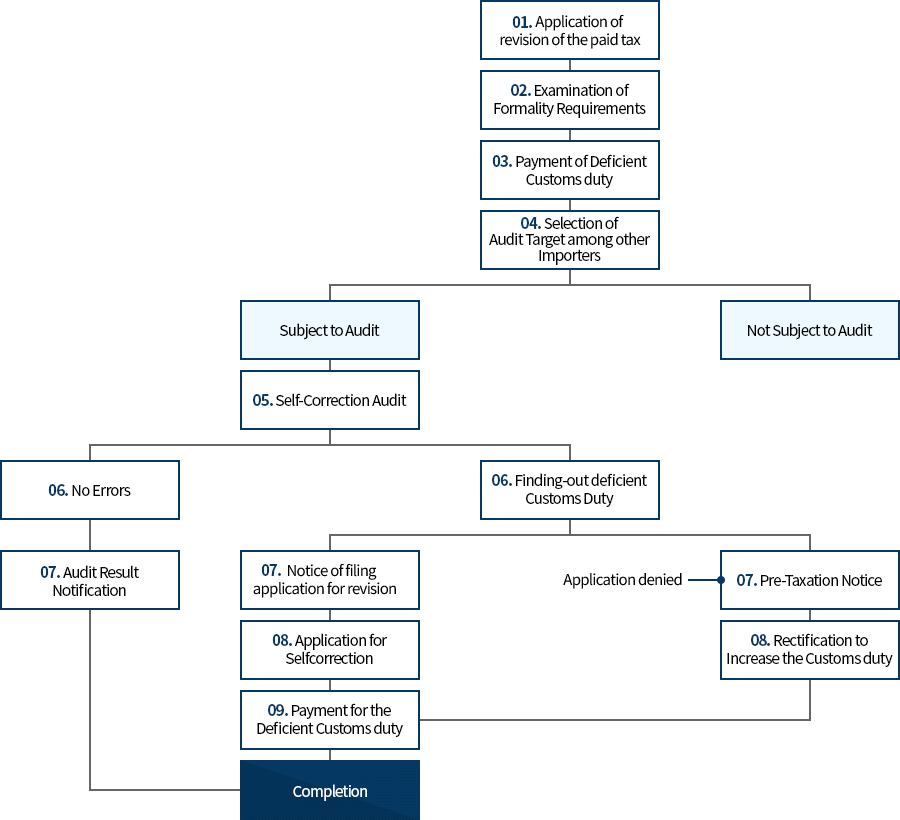

The workflow of the revision of tax paid

For More Information

Korea Customs Service, Corporation Audit Division, 042-481-7958