Apply for the Tax Payment Guidance Service

What is the Tax Payment Guidance Service?

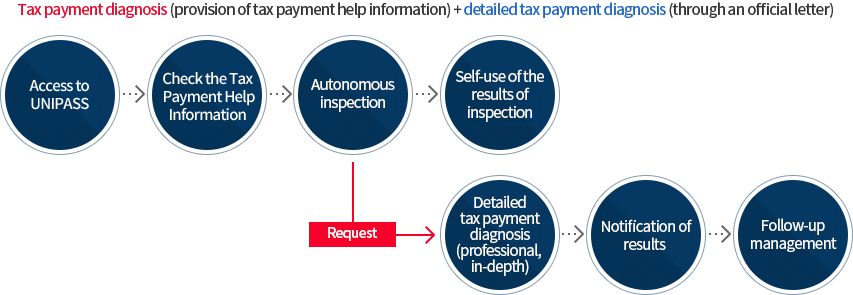

The service diagnoses the tax payment status of the requested company on a regular basis and provides the results to help correct errors in tax payment and report tax legitimately (tax payment diagnosis)

How to receive it?

Companies can receive the information through UNIPASS (Electronic Customs Clearance System)

What is the detailed tax payment diagnosis service?

Through the diagnosis of the audit officer, KCS provides an in-depth review and consulting for the errors found in the diagnosis of tax payment, at the request and with the cooperation of the taxpayer (diagnosis by an expert)

Tax payment diagnosis process

| - | Use of tax payment help information(tax payment diagnosis) | If confirmation of customs office is obtained in the process of use of tax payment help information(Detailed tax payment diagnosis) |

|---|---|---|

| Object |

All import companies |

Small & Medium enterprise and company of middle standing(Revenue of KRW 30 billion or less) |

| How to correct errors |

The company corrects the errors in tax payment by itself using the tax payment help information. |

Ask the customs office the questions raised in the process of correcting errors in tax payment by the company itself using the tax payment help information and handle the matter according to the answers. |

| Review and confirmation of customs office |

None |

The customs officer will check the status of the correction of errors in tax payment. |

| Benefits |

|

|

For More Information

Korea Customs Service, Corporate Audit Division 042-481-7784