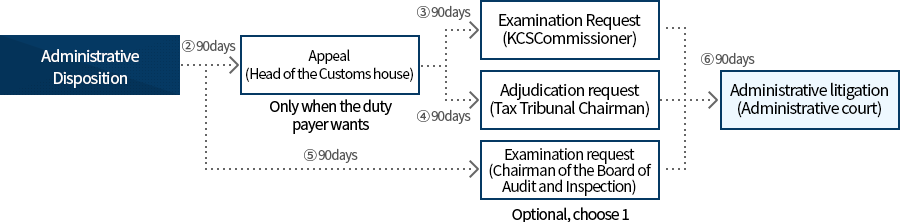

Information on the procedures for ex post remedies

Be aware of the procedures for ex post relief.

When disagreeing with the customs administrative disposition of the customs, duty payers can secure their rights through customs administrative remedies.

The period and institution for request by type of remedies are as follows:

| Remedy Type | Request Period | Institution | Decision Period | Note |

|---|---|---|---|---|

| ①Pre-Taxation Review | 30 days | Heads of main Customs/ KCS Commissioner | 30days | (KCS Commissioner) KRW 500 million or more |

| ②Appeal | 90days | Heads of Customs | 30days (60days when submitting evidentiary documents or evidence against the opinion of head of Customs office) |

If the Duty Payer wants |

| ③Examination Request | 90days | KCS Commissioner | 90 days | Optional/ Choose 1 |

| ④Examination Request to the Board of Audit and Inspection | 90days | Chairman of the Tax Tribunal | 90 days | |

| ⑤Adjudication Request | 90days | Chairman of the Board of Audit and Inspection | 3months | |

| ⑥Administrative Litigation | 90days | Administrative Court | - | 3-Tiered Judicial System |